How Transactions Impact The Accounting Equation

How Transactions Impact The Accounting Equation

The preceding balance sheet for Edelweiss represented the financial condition at the noted date. But, each new transaction brings about a change in financial condition. Business activity will impact various asset, liability, and/or equity accounts without disturbing the equality of the accounting equation. How does this happen? To reveal the answer to this question, look at four specific cases for Edelweiss. See how each impacts the balance sheet without upsetting the basic equality.

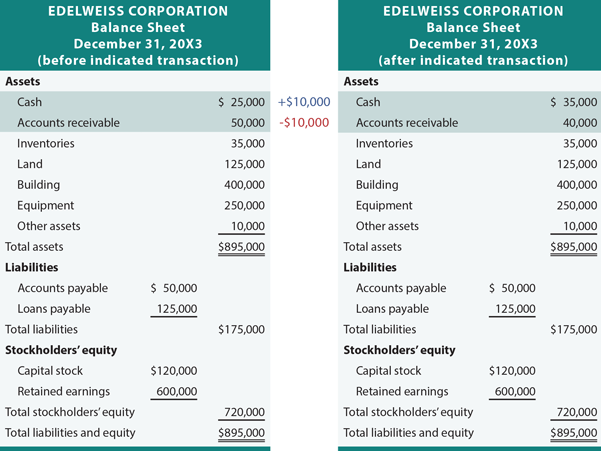

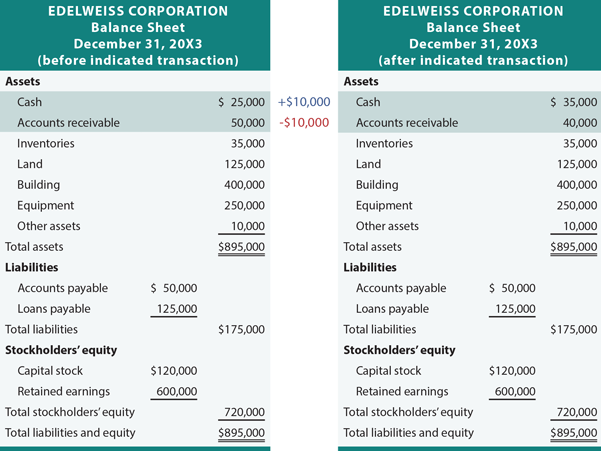

CASE A: COLLECT AN ACCOUNT RECEIVABLE

If Edelweiss Corporation collected $10,000 from a customer on an existing account receivable (i.e., not a new sale, just the collection of an amount that is due from some previous transaction), then the balance sheet would be revised to show that cash (an asset) increased from $25,000 to $35,000, and accounts receivable (an asset) decreased from $50,000 to $40,000. As a result total assets did not change, and liabilities and equity accounts were unaffected, as shown in the following illustration.

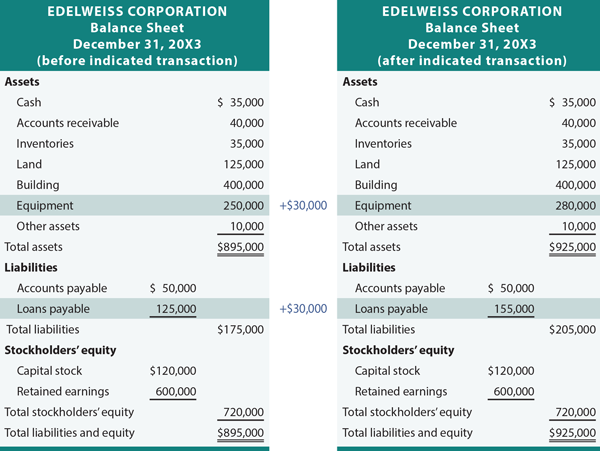

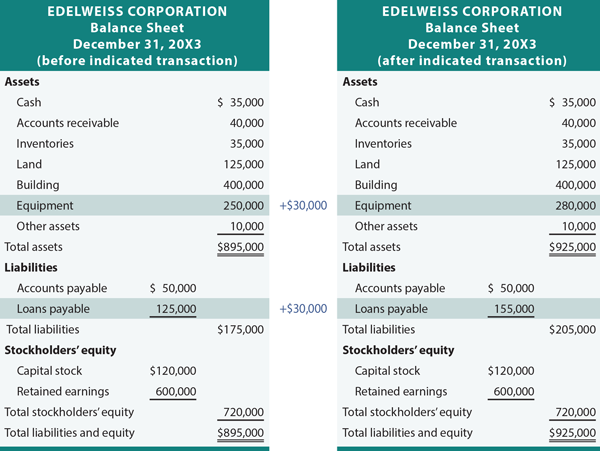

CASE B: BUY EQUIPMENT VIA LOAN

If Edelweiss Corporation purchased $30,000 of equipment, agreeing to pay for it later (i.e. taking out a loan), then the balance sheet would be further revised. The Case B illustration shows that equipment (an asset) increased from $250,000 to $280,000, and loans payable (a liability) increased from $125,000 to $155,000. As a result, both total assets and total liabilities increased by $30,000.

No comments:

Post a Comment